reit tax benefits ireland

They are generally exempt from Corporation. For one REITs pay no corporate income tax if they pay at least 90 of their taxable income to shareholders as dividends.

5 Popular Uk Reits Among Investors In November 2022

Which Ireland has a double taxation agreement DTA or treaty may be able to reclaim some of the DWT if the relevant tax treaty permits.

. Irish resident corporate investors will be liable to 25 corporate tax. Profits and gains from any other activities carried on by the REIT. Where shares in a REIT are held by an investment.

What is the percentage of REITs. 7 Distributions are not guaranteed and may be. Exempt from corporation tax on both rental income and gains on sales of investment properties and shares in property investment companies used in a UK property.

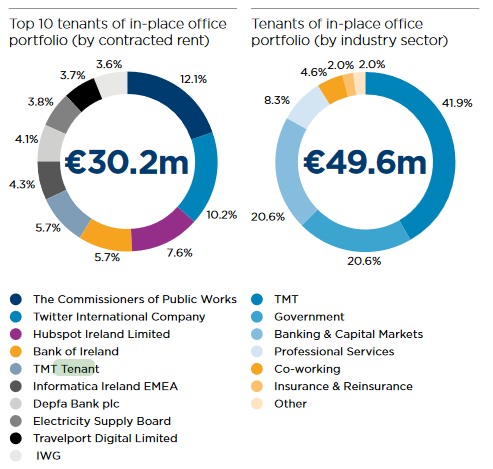

Limited partnerships and limited liability companies are generally the preferred vehicles for private investment in real estate due to their flexibility low cost and tax efficiency. Again this could reach a combined rate. Distributing a high percentage of their rental income Irish REITs must distribute 85 of property related income.

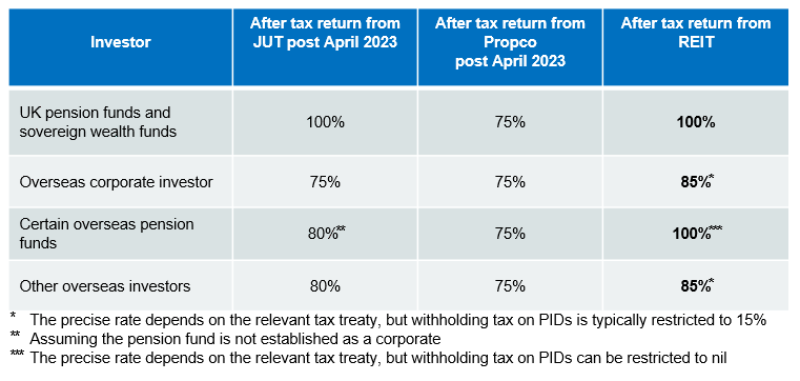

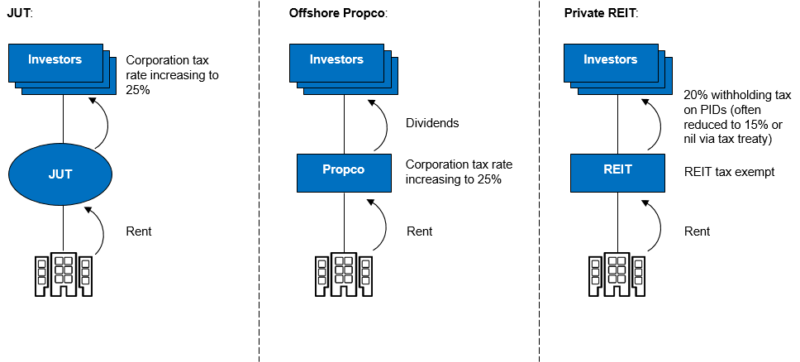

In the context of the classical system the Irish REIT regime eliminates tax at the company level and pushes all of the tax obligation onto shareholders. Current federal tax provisions allow for a 20 deduction on pass-through income through the end of 2025. To eliminate the double layer of taxation which typically hinders the holding of property through a company a REIT is exempt from corporation tax on qualifying profits from.

Under the Tax Act REITs provide an additional benefit for tax-exempt investors. Real Estate Investment Trusts REITs REITs are companies who earn rental income from commercial or residential property. Or group of connected persons can control the REIT.

Key features of a UK REIT. The main benefit of having REIT status is profits and gains from the property rental business are exempt from corporation tax. As we retain a favourable view on the outlook for the Irish.

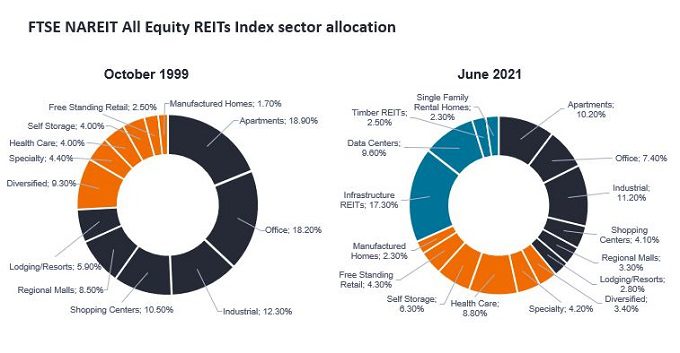

In addition REIT investors benefit from a 20 rate reduction to individual tax rates on the ordinary income portion of distributions. Historically tax-exempt investors were able to net income and losses from various UBTI. Real Estate Investment Trusts REITs are recognised as important vehicles for property investment in over 30 jurisdictions throughout the world.

A REIT is exempt from corporation tax on qualifying income and gains from rental property subject to a high profit distribution. Web The tax regime for the operation of Real Estate Investment Trusts REIT in Ireland was introduced in Finance Act 2013 which inserted Part 25A into the Taxes. Most of the distribution from a REIT is taxed as ordinary.

Principal and interest payments on any borrowings will reduce the amount of funds available for distribution or investment in additional real estate assets. Individual REIT shareholders can deduct 20. Irish REITs will be listed on the main.

Tax benefits of REITs. An Irish resident individual owning shares in an Irish REIT will be subject to Income Tax and USC on the dividends from the REIT. Irish resident shareholders in a REIT will be liable to income tax on income distributions from the REIT plus PRSI and USC.

Low take-up to date.

The Continuing Rise Of The Reit

What Is A Data Center Reit Dcd

Alternative Investments Ireland Tax Advantages Investors Asset Management

Investing In The Future With Reits 3 0 Janus Henderson Investors

How Our Tax System Rewards Foreign Investors In Irish Property

Quick Overview Of Irish Real Estate Rsm Ireland

Diversify Your Income With Irish Reits Seeking Alpha

The Taxman Cometh Reits And Taxes

Ireland Inc Bets Big Multinational Footprint Can See Off Tax Overhaul Reuters

Real Estate Investment Trusts Tax Adviser

3 Tax Smart Alternatives Cohen Steers

Diversify Your Income With Irish Reits Seeking Alpha

3 Tax Smart Alternatives Cohen Steers

Doing Business In The United States Federal Tax Issues Pwc

A General Introduction To Real Estate Investment Taxation In Ireland Lexology